The Federal Emergency Management Agency (FEMA) has found that 61 percent of surveyed Americans have not created or practiced an emergency plan, while 80 percent of Americans live in counties that have experienced natural disasters. Not having an emergency plan might mean losing a loved one or pet. For small businesses, it might mean financial collapse.

With the unpredictable weather patterns effecting most of the world, there's no real excuse for not being prepared, since so much of it is simply planning, practice, and controlling panic. If you're stressed about money or the different things you might need to buy, here are some tips for emergency preparedness on a budget. Preparation is far less about MREs and much more about having an open and honest discussion of your plans with your family.

Understanding the Risks for Your Area

Million-dollar natural disasters have touched every single state, and no home is completely safe from one problem or another. They might not be small crises, either: According to the National Oceanic and Atmospheric Administration (NOAA), there have been 26 floods, 25 droughts, 40 hurricanes or tropical cyclones, 15 wildfires, nine deep freezes, 16 winter storms, and 99 severe storms, all costing more than $1 billion since 1980. These are super-storms, and they happen frequently, often requiring families to evacuate.

While yes, it's true that some areas of the U.S. are more likely to be struck by natural disasters than others, each area has its own unique risks that certainly won't make them exempt. That's not to mention that the threat of climate change creates more, more deadly, and more unusual natural disasters.

Then there are still other unlikely but possible scenarios: Tsunamis can affect New York City, volcanoes can affect the central plains, and really, asteroids are always a vague threat we can do nothing about. But it's important to focus on the things we can do something about, what we can (and should) prepare for.

Here are a few likely scenarios:

If you live in the Northeast, generally, your greatest risks are flooding, winter weather, and severe storms.

If you live in the South, generally, your greatest risks are hurricanes, tornadoes, flooding, and mudslides.

If you live in the Central U.S., your most likely disaster scenarios are wildfires, severe storms, and, in some cases, extreme winter weather.

If you live on the West Coast, you'll likely contend with earthquakes, winter weather advisories, wildfires, and flooding.

Hawaii is not often a contender for hurricanes, but that risk has been increasing in recent years. There's also a risk of tsunamis, fire, and flooding overall. Alaska suffers from extreme winter weather, avalanches, wildfires, and earthquakes. The state is home to a few volcanoes as well.

It also may be smart to look at the worst disasters in your state and look up information on past extreme weather in your own hometown or county.

Form a plan based on these likely scenarios when creating your emergency kit and figuring out different aspects of your plan.

Here are a few less likely but possible scenarios:

- A nuclear event would be a nightmare scenario, and there wouldn't be much you could do to avoid getting hit. See what it would be like if a nuke was dropped on your hometown to get an idea of what you'd be dealing with. Here's what you can do in the first 10 to 15 seconds: The overall advice is to get inside and stay inside. As soon as the warning signs hit, find a shelter. (Naturally, it's a good idea to find your local shelters in advance regardless of if you believe a nuclear attack is actually possible.) Then, avoid the fallout, or radioactive ash, which looks like a poisonous snow. Concrete can help shield you from the ash. Experts say you must wait at least a week before it's safe to leave.

- An infectious disease outbreak or bioterrorism attack can sound very scary, but infectious outbreaks happen all the time around the world without us knowing. The most important things are to practice good hygiene such as handwashing, avoid travel or crowded places (definitely airports), use a face mask, in some cases avoid animals and raw meats, and, when needed, listen to authorities, especially the Centers for Disease Control and Prevention (CDC).

- Natural disasters that don't make sense for your area are possible, from a random earthquake in a city not built for them to a sudden flood in a dusty town. While it might not make sense to have winter-ready materials in your emergency kit in the south, winter storms and power loss can be an extra-deadly mix in those areas. (Pro tip: Buy cans of beans, not bread and milk!) Talk to your friends from other cities about what they do, and take a moment to prepare for these unlikely cases.

- A solar flare or an unusual space-threat could wipe out communications for a while. Typically, this would cause a panic only, since we rely so much on satellite communications. Most space-related threats would likely relate to missile strikes. And in the event that aliens have come to say hi, the important thing would be to stay calm!

While these may be possible, the bulk of your disaster planning should center around low-hanging fruit of plausible scenarios and easy changes. Create a disaster plan around those aspects, and maybe touch upon these unlikely scenarios as a thought experiment. And remind your family not to panic!

These disasters are so extreme that they're impossible to prepare for anyway, right? Of course not, as a few simple things you can do as a family will save a lot of trauma, time, and money in the long run.

Find out how to make your home safer. Regularly check your home for safety issues.

- For example, in a region with many hurricanes or tornadoes, make sure loose gutters, lawn furniture, or other dangerous debris won't be picked up. In a blizzard-prone region, make sure your home is properly insulated with no holes to the outside world.

Fill out and print numerous copies of your Family Emergency Communication Plan sheet. Organize all of your emergency numbers, and make sure everyone in the family has a copy of this sheet. Kids in school might even want to give the sheet to their teachers.

Create and communicate your plan with your family (see the next few sections). Use this plan from the American Red Cross, or create an outline based on what to do during each of the most likely emergencies in your area.

- Include emergency meeting points in case communications go down!

- Create an evacuation route and plan. If you don't have a car, you'll have to communicate and accommodate even more.

- Find shelters and safe spots. On the day of, you may need to text SHELTER and your ZIP code to 4FEMA (or 43362) to find government shelters and assistance. They also should be listed on the mobile app.

Create an evacuation checklist. There's a lot that needs to happen really fast during an evacuation, including things that could save you thousands in repairs, from turning off power to grabbing your supplies. Creating a checklist and leaving it on your fridge can help control the chaos.

Delegate tasks and plan for people and pets who cannot self-advocate. The shortage of time requires that other who are capable in the group will need to pitch in. Give everyone who can do a job a safe, clear task. A child might need to grab your pet. A parent will need to turn off utilities.

Test your communication. Make sure everyone knows their role in an emergency, where they're supposed to be, and how to communicate with each other. Create a phone plan and test it out frequently, making sure everyone knows what to do next.

Practice drills as much as possible. More than your communication plan, it's important to practice drills, especially for kids. Make sure they have visited and know how to get to your meet-up spots on their own. Practice as many times as you can for different scenarios.

Create your disaster kit. We'll go into detail about what you'll need. Don't forget copies of your family's most important documents, like IDs and insurance information.

It's important to make sure that all adults in the household have the same plan and communicate the same information. For everyone else, here are some tips.

Discussing the Plan With Your Children

Remember: Children are likely to be at school when an emergency hits!

- Get your kids on your team with the free online game Disaster Master from Ready.gov.

- Print and fill out the communication plan and keep it in your child's book bag, and consider giving a copy to your child's teacher.

- Have them memorize your address, your phone number, and your full name. (You'd be surprised how many young children only know "mom" or "dad," especially when they're panicked.)

- Make sure they have a point of contact outside of the state, like an aunt, uncle, or grandma. Make sure they know her address, phone number, and name.

- Make sure you've reviewed where you're going to meet in an emergency and the child has practiced going there.

- Make sure the child has some way to contact you. If it's not an immediate emergency, texting is easiest, as you won't tie up phone lines.

- Make sure your child knows what to do if they can't communicate with you.

- If your child can handle it, teach them some very basic first aid, such as the five steps to save a life.

- Discuss other elements of safety, like stranger danger, electrical safety, and how to call 911 responsibly.

If you have a very small child or a baby, caring for it can be very difficult during a natural disaster. They will be obviously unable to communicate and need a lot of care during an evacuation situation. Be sure to delegate tasks in this case; one person should be looking after the baby while other adults can help everyone else.

- You'll need to pack extra clothes, diapers, wipes, rash cream, bottles and formula, age-appropriate snacks, distracting toys and pacifiers, baby first aid items, and portable baby carriers.

- If you have a day-care provider, make sure they have a list of phone numbers and/or a copy of the communication plan.

- If you are pregnant, make sure you know of hospitals that will take your insurance outside of your state.

Taking Extra Steps for Seniors and Disabled People

Disasters can be very difficult for disabled people and seniors, who have their own mobility and packing needs. Make sure each person has their own list of items to grab or even their own emergency kit. Never make assumptions about their situation, and be sure to check on them and offer help.

- Be sure the person has a personal support network of people who can help in times of need.

- Make sure any personal assistants and caretakers have their own copy of the family emergency communication plan.

- Transportation should be considered early if mobility is an issue. It will get more difficult the longer you wait to evacuate.

- Pack any adaptive devices, such as feeding devices, shower chairs, or specialty transportation devices. Be sure to bring a set of non-electricity-dependent equipment if it's an option.

- Bring medications, adult diapers, and extra batteries for devices (including packs for rechargeable battery power).

- Those with memory-related issues or disabilities will need to have contact information on their person. When emergencies happen, they may panic, so make sure they have supervision.

Discussing the Plan With Your Neighbors/Friends

It might be too nerve-wracking and you may not want to talk to random neighbors, but your neighbors are the most important group to know well if and when a disaster happens. If at all an option, try to get the ball rolling in your neighborhood to do at least one, if not all, of these things:

- Create your Neighborhood Emergency Plan, which includes the ever-important map and list of resources. Create "block captains" who have the most emergency experience.

- Meet regularly with a group of neighbors to discuss emergency plans.

- At the very least, create and regularly test a phone tree.

Creating a Plan for Your Pet

Obviously, you can't exactly talk to or rehearse an emergency with your dog, cat, or other type of pet. But it's pretty unforgivable to leave your pets behind. Avoid the last-minute panic of taking care of your pet by doing some prep work.

- Get a free Rescue Alert sticker from the ASPCA.

- Make sure your dog or cat has a collar with tags that have your current phone number.

- Find hotels, shelters, and places that take pets. As a backup, call your local veterinarian to see which boarding kennels would be preferred in the event of an emergency, including out-of-state options.

- Delegate caregiving to a family member.

- Make sure you have a recent photo of your pet as well as health records.

- Pack extra food, litter, a leash, water bowls, and other pet needs in your emergency kit.

- Birds should be transported in a secure carrier.

- If you have a horse, practice getting them into a clean and functional trailer relatively quickly.

- Bring blankets and jackets to help keep your pets warm.

You don't have to be a survivalist to learn basic skills and do some simple prep work outside of your plan and your kit.

Use this disaster preparedness checklist to buy and organize the specific items you need. It would be smart to keep these items together or even in an easy-to-grab suitcase or stuff it all together in a trash can. There are numerous ways to organize and save your supplies.

What to Put in an Emergency Supply Kit

Water:

The general wisdom is one gallon per person per day for a minimum of three days.

Food:

Keep a supply of nonperishable food (such as cans) for a minimum of three days

First Aid Kit:

The Red Cross recommends all of these items in your kit, or you can buy a prepackaged one with a coupon. Remember: it's not just Band-Aids!

Tools:

You'll need a can opener for the food, wrenches or pliers (for turning off your utilities), and perhaps a hammer (if you'll need to make camp).

Sanitation Supplies:

You'll want moist towelettes, garbage bags, and plastic ties.

- Dust Mask and Plastic Sheeting: In many scenarios, especially during wildfires, you will want to shield your lungs with a mask, and you may need to make your space more airtight in a disaster using plastic sheeting.

- DIY Disinfectant: Dilute one part unscented bleach to nine parts water and put it in a medicine dropper. This can be used to disinfect items in an emergency.

Flashlight:

Always bring extra batteries!

Whistle:

You should also have a whistle to signal for help.

Copies of Important Documents:

In a waterproof, safe container, store important family documents such as bank account information, insurance policies, copies of IDs such as your driver's license, reference materials or how-to survival books, and any traveler's checks. You may also want to hide some cash in this container. Make sure it's not easily stolen.

Blankets and Clothing:

Grab a change of clothes and a blanket for each person.

- Extreme Cold Weather Sleeping Bags, Thermal Blankets, and Spare Jackets: Spare layers stored in water-resistant containers are particularly important to pack if you live in cold weather regions where dry clothes could mean life or death. Rescue blankets might be a good idea no matter where you live due to the fact that they're so lightweight and the fact that many new parts of the country have been experiencing oddly wintry conditions lately.

Matches:

Keep them in a waterproof container. A knife and ferro rod can work in emergencies, too, assuming you can find a dry area.

- Fire Extinguisher: Do not attempt to approach a fire if you live in a wildfire zone, but keep this handy for your protection.

From natural disasters like hurricanes and floods to public health and ecological crises, there are many circumstances for which you should be financially prepared.

The key to financial emergency preparedness is proper planning. You need to take stock of your income streams — such as an annuity, 401(k) or IRA plan, a salary or other source — budget appropriately and prepare for the unexpected.

Financial emergencies can happen to anyone, and without a plan, you may find it difficult to bounce back from damages. In turn, this could put your credit score at risk and even cause you to file for bankruptcy.

We hope disaster never strikes — but in today’s climate we also know nothing is guaranteed. So why not do a little legwork upfront to ensure you’re financially healthy no matter what? Here, we cover what to do with your finances before, during and after a disaster to ensure you’re protected.

Before a Disaster: How to Prepare

Multiple recent studies have shown that Americans are woefully underprepared for disasters and the sudden expenses that often come with them:

- Approximately 40% of Americans have no plan for handling an emergency.

- Only 16% of Americans have an emergency preparedness kit.

- About 55% of Americans worry about an unplanned financial emergency.

- Six in 10 Americans would be unable to cover an unexpected $500 expense.

Rarely do people regret being too prepared — it’s the opposite that’s all too common. To ensure you and your family don’t fall under the statistics above, consider taking the time to set up a few things now.

Keep these papers somewhere easily accessible to ensure you take them with you in the event you have to suddenly evacuate your home.

During a Disaster: What to Do

If you do end up finding yourself in a disaster or emergency situation, you’ll be thankful you put in the work to form a plan. Unprecedented events often pile on extra stress, but if you’re financially prepared, you’ll have one less thing to worry about. That way, you can focus on keeping yourself and your loved ones safe.

During a disaster, you likely have a lot on your mind, and manually paying bills may easily slip through the cracks. If you sense a disaster situation is imminent, set up automatic payments so that you don’t have to worry about late or forgotten payments.

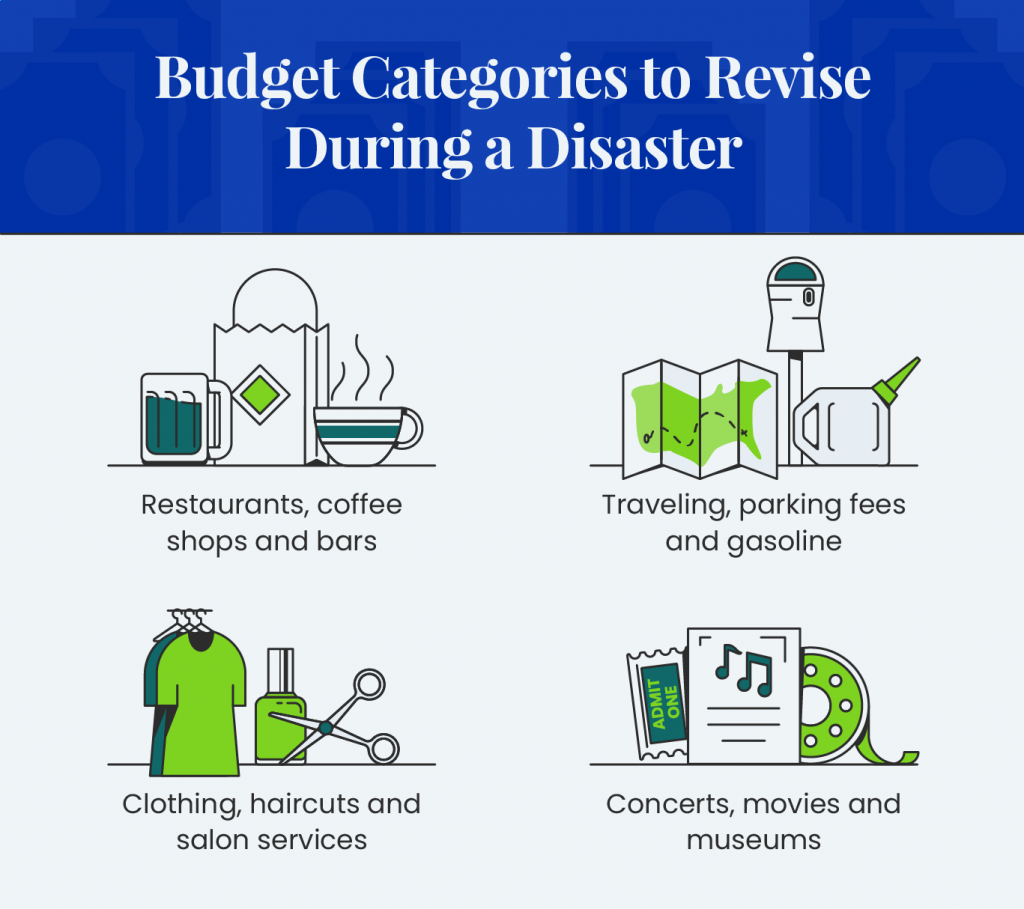

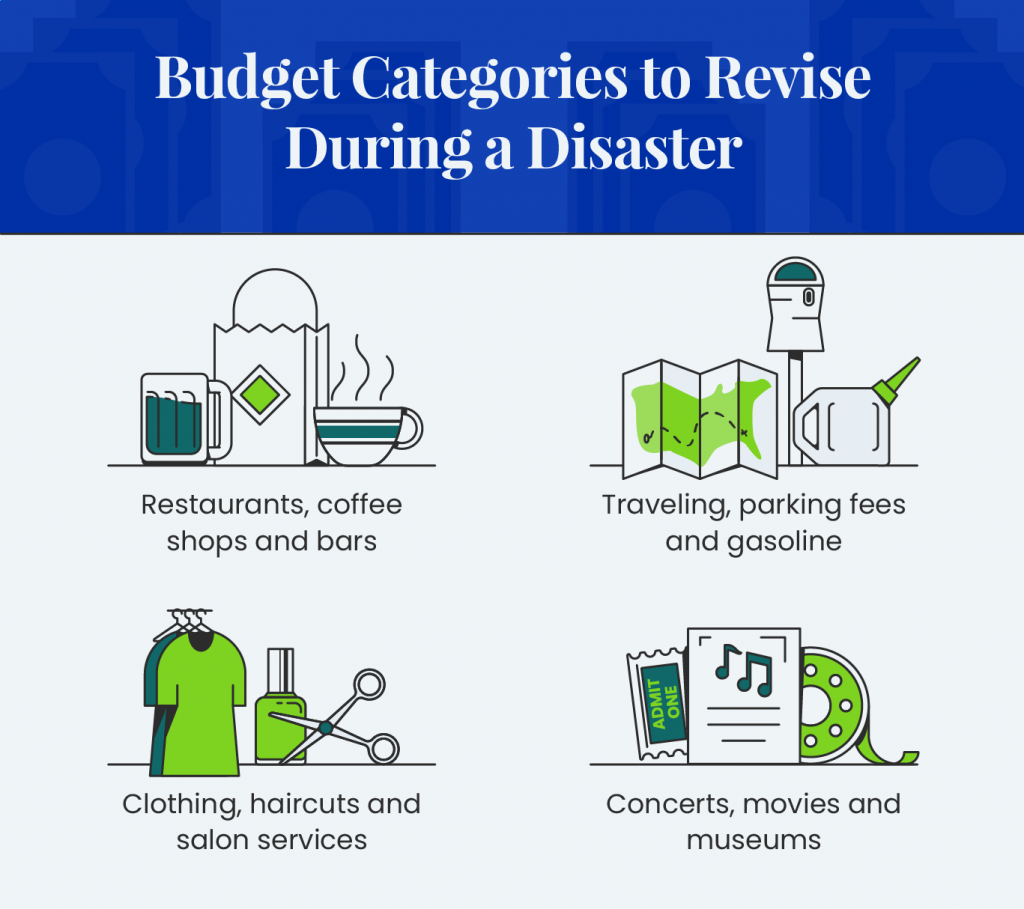

Reallocate this money to focus on necessary expenses or sock it away if you anticipate hefty repairs or medical bills after the disaster is over. You may also opt to donate this money to disaster relief organizations.

After a Disaster: How to Recover

Once the disaster has passed and you begin to resume normal life, there are some immediate action items you’ll want to take care of to best assist your recovery.

Additional Resources

For additional information pertaining to financial emergency preparedness, explore the federal resources below:

No one expects a devastating event, and we can never be fully prepared for everything. But having a solid financial preparedness plan can pay off in huge ways if disaster ever does strike.

Building solid savings, creating a preparedness plan and reading up on available resources can help protect your financial well-being. It will also give you the peace of mind of knowing you’ve done your part to prepare for whatever comes your way.

Please seek the advice of a qualified professional before making financial decisions

Feeling confident in your plan? Spread the word about how easy it is! And if you're super-confident, see if there are ways locally to get involved with community preparedness.